China’s Green Leap Outward: The rapid scale- up of overseas Chinese clean-tech manufacturing investments

A new China Low Carbon Technology FDI Database

XIAOKANG XUE, Researcher, Net Zero Industrial Policy Lab

MATHIAS LARSEN, Postdoctoral Research Associate, Watson School of International and Public Affairs, Brown University

September 9, 2025

Executive Summary

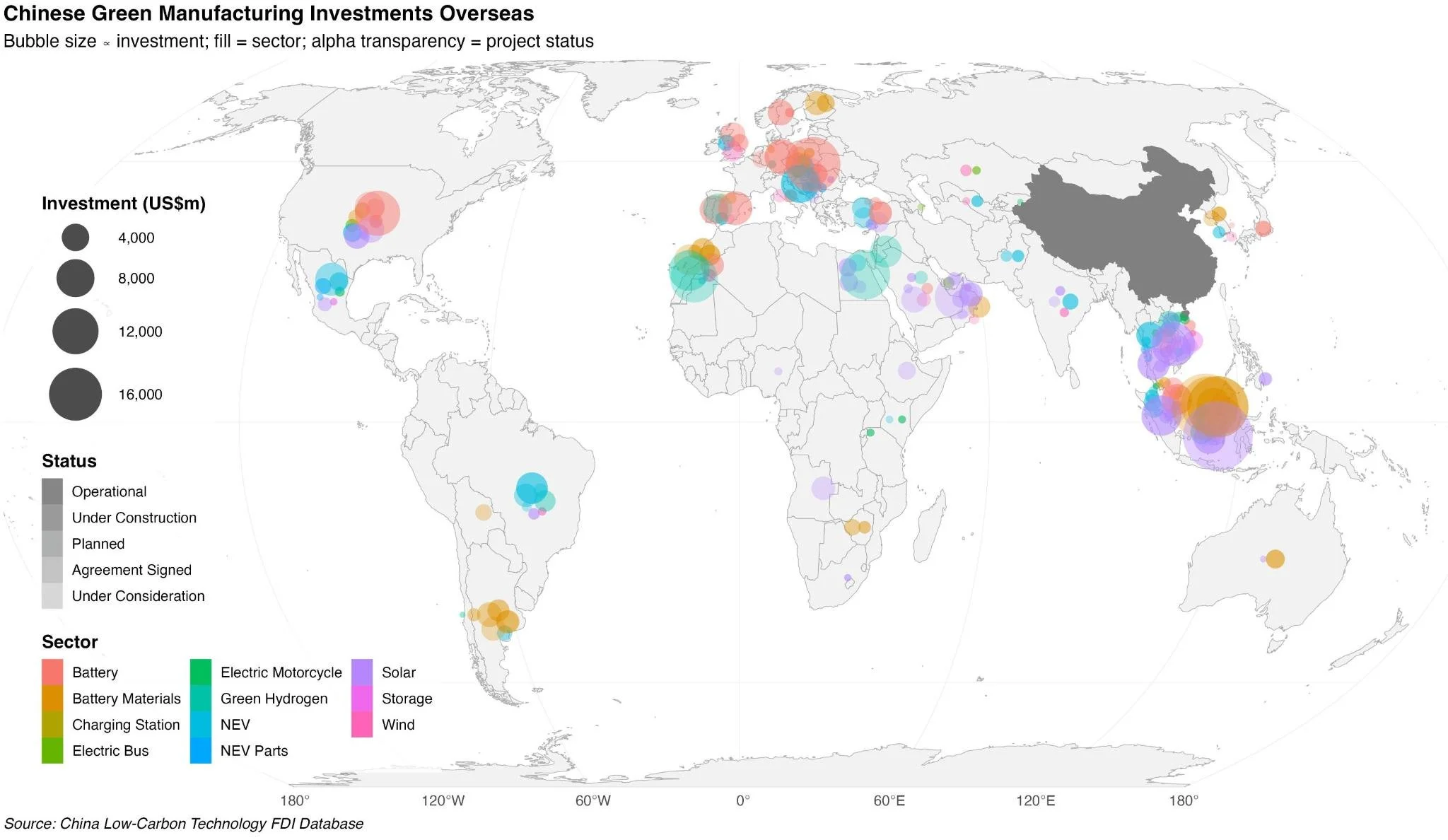

A rapid acceleration in overseas investment by Chinese green technology manufacturers is reshaping the global clean-tech landscape. Since 2022 alone, investments have surged past USD 220 billion, spanning sectors such as batteries, solar, wind, new energy vehicles (NEVs), and green hydrogen. These investments now reach 54 countries across every major region. This policy brief offers the first comprehensive overview of China’s expanding global green manufacturing footprint, drawing upon our database.

“To provide a rigorous empirical basis for such assessments, the China Low Carbon Technology FDI Database was launched in early 2025. The database is a preliminary part of the broader Global Low Carbon Technology FDI database, hosted by NZIPL at Johns Hopkins University and GDP Center at Boston University.”

The database catalogues 461 green-technology manufacturing projects announced between 2011 and the first half of 2025 (methodology in appendix). The 11 low carbon technology types in the database are: batteries, battery materials, charging infrastructure, electric buses, electric motorcycles, green hydrogen, new energy vehicles (NEVs), NEV parts, solar, storage, and wind. Projects are, most centrally, mapped by year, country, clean technology type, company, investment scale, production capacity, and project status.

MAIN FINDINGS

● Investment volume: Chinese firms have pledged at least USD 227 billion across green manufacturing projects. A high-end estimate approaches USD 250 billion. This surge of overseas green manufacturing investment is unprecedented; it now surpasses the USD 200 billion (in current 2024 dollars) invested by the US over four years of the Marshall Plan, at a time of similar American dominance of manufacturing in key industries.

● Post-2022 acceleration: Investments surged beginning in 2022, with 387 projects— over 80% of the total—launched since that year. A record 165 projects were announced in 2024 alone. Since 2022, Chinese firms have committed over USD 210 billion, accounting for approximately 88% of total disclosed capital.

“In each year since 2022, the pledged investment exceeded the total amount committed over the entire previous decade.”

● Sector diversification: Solar dominated pre-COVID, but since 2021, capital has fanned out to battery materials, full battery plants, New Energy Vehicle’s (NEV), charging equipment, wind, and early-stage green hydrogen.

● Regional re-balancing: ASEAN still hosts the most projects, yet 2024 saw MENA’s share jump to over 20 % of new deals; Europe remains key for downstream batteries, while Latin America and Central Asia enter the map.

“Over 75 percent of the projects in the database are located in the Global South or emerging markets.”

● Hot-spots:

● Indonesia—linchpin for nickel-rich battery-material projects and new solar lines.

● Morocco—cathodes and green-hydrogen for EU supply chains.

● Gulf states—solar module and electrolyser manufacturing backed by sovereign offtakes.

● Hungary, Spain, Brazil, and Egypt—sector-specific hubs for batteries, hydrogen, or mixed clean-tech plays.

● The geographic distribution suggests that investment motivations can be categorized into three types: Seeking access to host countries markets, access to third-country markets, or access to raw material inputs.

● Megaprojects: Chinese investments include 60 projects exceeding USD 1 billion.